The Franchise Tax Board (FTB) is a critical entity in California's financial and regulatory landscape, tasked with the administration of state tax laws and ensuring compliance among businesses and individuals alike. Established to oversee the collection of taxes, the FTB plays a pivotal role in funding public services and infrastructure. Its responsibilities extend beyond merely collecting taxes, as it also provides resources and support to taxpayers to ensure they meet their obligations. Whether you're a business owner, an independent contractor, or a resident taxpayer, understanding the functions of the Franchise Tax Board is essential to navigating California's tax system effectively.

For many, the Franchise Tax Board is synonymous with filing annual tax returns, but its scope is far broader. It enforces tax laws, audits discrepancies, and resolves disputes between taxpayers and the state. The FTB ensures that California's tax revenues are collected fairly and efficiently, contributing to the state's economic stability. With its comprehensive online tools and customer service channels, the Franchise Tax Board serves as a bridge between taxpayers and the state government, simplifying what can often be a complex process.

Given its importance, staying informed about the Franchise Tax Board’s policies and procedures is vital for anyone operating within California. From understanding tax obligations to resolving potential issues, the FTB is a cornerstone of the state's financial ecosystem. This article delves into the key aspects of the Franchise Tax Board, answering common questions and offering practical guidance for taxpayers. Whether you're seeking clarity on tax filing requirements or exploring how the FTB impacts your financial responsibilities, this guide has you covered.

Read also:Discover The Ultimate Movie Streaming Experience With Yomoviecom 2024

Table of Contents

- What is the Franchise Tax Board?

- How Does the Franchise Tax Board Affect Businesses?

- What Are the Key Responsibilities of the FTB?

- How Can You File Taxes Through the FTB?

- What Happens If You Miss a Deadline?

- How to Resolve Disputes with the Franchise Tax Board?

- Common Misconceptions About the Franchise Tax Board

- Benefits of Using FTB Online Services

- Who Needs to Pay Franchise Taxes?

- How Can You Stay Compliant with FTB Requirements?

What is the Franchise Tax Board?

The Franchise Tax Board is an agency within the state of California responsible for administering tax laws and ensuring compliance. Established in 1929, the FTB was created to manage the collection of state income taxes, which are a primary source of revenue for California. Over the years, its role has expanded to include overseeing franchise taxes, enforcing tax laws, and providing taxpayer assistance. The FTB works closely with other state agencies to ensure that tax policies align with broader economic goals.

How Does the Franchise Tax Board Affect Businesses?

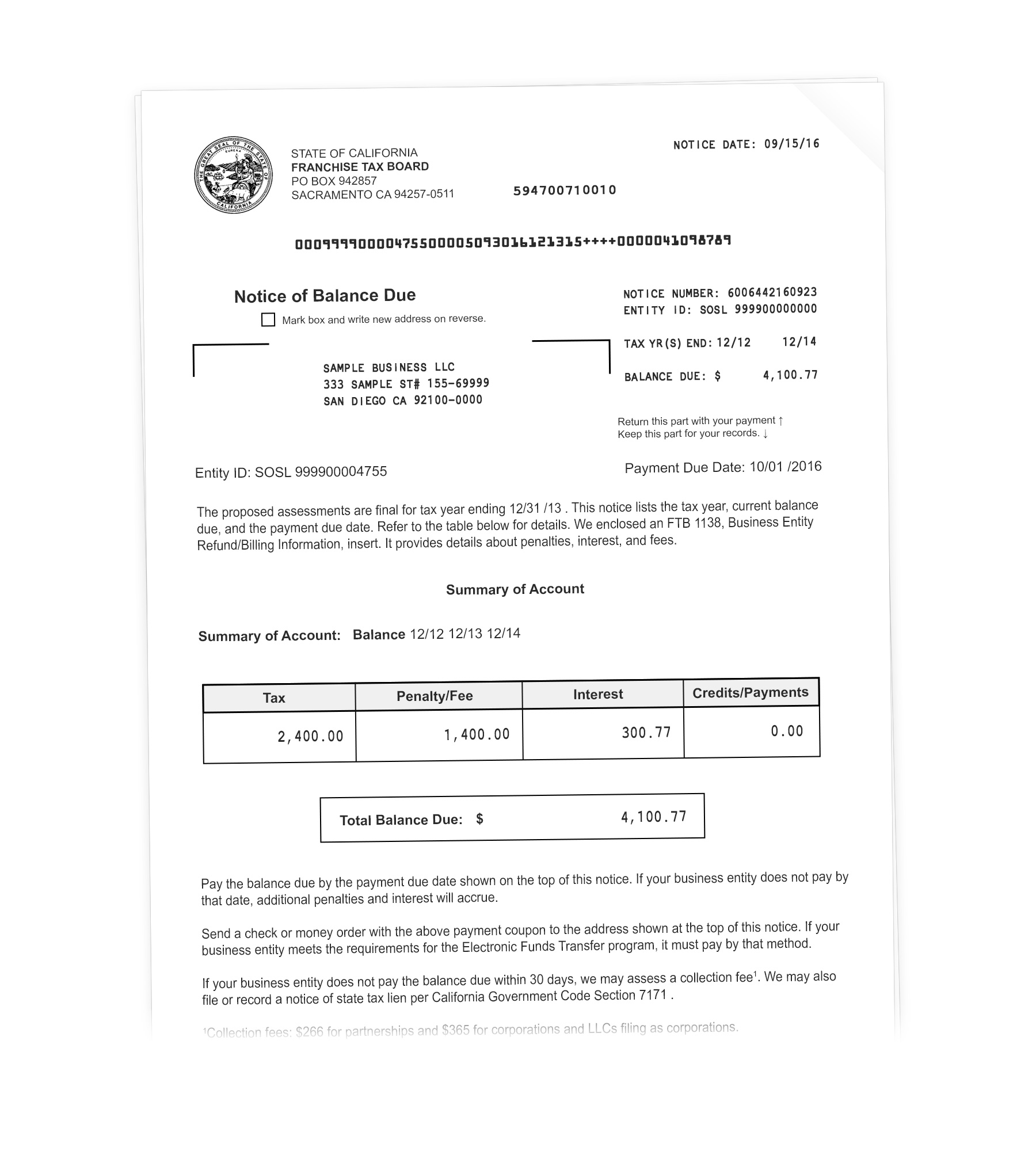

For businesses operating in California, the Franchise Tax Board plays a significant role in determining tax liabilities. All corporations, LLCs, and other business entities are required to pay franchise taxes, which are calculated based on their annual income and other factors. The FTB ensures that businesses comply with these obligations by conducting audits and imposing penalties for non-compliance. Understanding how the Franchise Tax Board affects businesses is crucial for maintaining financial health and avoiding legal issues.

What Are the Key Responsibilities of the FTB?

Read also:Sone 385 Download Your Ultimate Guide To The Trending App

The Franchise Tax Board has a wide range of responsibilities, including the collection of personal income taxes, corporate taxes, and franchise taxes. It also administers various tax credits and deductions, ensuring that taxpayers receive the benefits they are entitled to. Additionally, the FTB resolves disputes, processes refunds, and provides educational resources to help taxpayers understand their obligations. These responsibilities make the FTB a cornerstone of California's financial infrastructure.

How Can You File Taxes Through the FTB?

Filing taxes through the Franchise Tax Board is a straightforward process, thanks to its user-friendly online platform. Taxpayers can submit their returns electronically, making it easier to track their status and receive refunds. The FTB also offers paper filing options for those who prefer traditional methods. Whether you're filing as an individual or a business, the FTB provides detailed instructions and resources to guide you through the process.

What Happens If You Miss a Deadline?

Missing a tax deadline can have serious consequences, including penalties and interest charges. The Franchise Tax Board enforces strict deadlines for filing returns and paying taxes, and failure to comply can result in financial repercussions. However, the FTB offers options for taxpayers who are unable to meet deadlines, such as extensions and payment plans. Understanding these options can help you avoid unnecessary penalties.

How to Resolve Disputes with the Franchise Tax Board?

Disputes with the Franchise Tax Board can arise for various reasons, such as disagreements over tax assessments or penalties. The FTB has a formal process for resolving these disputes, which includes filing appeals and attending hearings. Taxpayers are encouraged to seek professional advice when dealing with disputes to ensure their rights are protected. Resolving disputes with the Franchise Tax Board requires patience and a thorough understanding of the process.

Common Misconceptions About the Franchise Tax Board

There are several misconceptions about the Franchise Tax Board that can lead to confusion among taxpayers. One common myth is that the FTB only deals with businesses, when in fact, it also oversees individual income taxes. Another misconception is that the FTB is solely punitive, whereas it actually provides numerous resources to assist taxpayers. Understanding these misconceptions can help you navigate the FTB's services more effectively.

Benefits of Using FTB Online Services

The Franchise Tax Board offers a range of online services that make tax management more convenient. These include electronic filing, payment options, and account management tools. Using FTB online services can save time and reduce errors, ensuring that your tax obligations are met efficiently. Additionally, the platform provides real-time updates and notifications, keeping you informed about your tax status.

Who Needs to Pay Franchise Taxes?

Franchise taxes are levied on businesses operating in California, including corporations, LLCs, and partnerships. The amount owed is based on the entity's income and other factors, such as its type and structure. Understanding who needs to pay franchise taxes is essential for compliance and avoiding penalties. The Franchise Tax Board provides detailed guidelines to help businesses determine their tax liabilities.

How Can You Stay Compliant with FTB Requirements?

Staying compliant with the Franchise Tax Board's requirements involves understanding your tax obligations and meeting deadlines. This includes filing accurate returns, paying taxes on time, and maintaining proper records. The FTB offers resources and tools to help taxpayers stay compliant, such as workshops and online guides. By staying informed and proactive, you can ensure a smooth and hassle-free experience with the FTB.

In conclusion, the Franchise Tax Board is an essential part of California's financial system, impacting both individuals and businesses. By understanding its role and responsibilities, you can navigate the tax landscape with confidence and ensure compliance with state regulations. Whether you're filing taxes, resolving disputes, or seeking assistance, the FTB provides the resources you need to succeed.